Special Report Student Loan Debt Among Educators

No matter who we are or how big our bank accounts, we should be able to learn without limits.

From national advocacy to individual support, NEA is working to ensure that education is affordable and accessible to all. As part of this work, we conducted research analyzing the state of educator student loan debt and the ways we can work together to make a more just system for all.

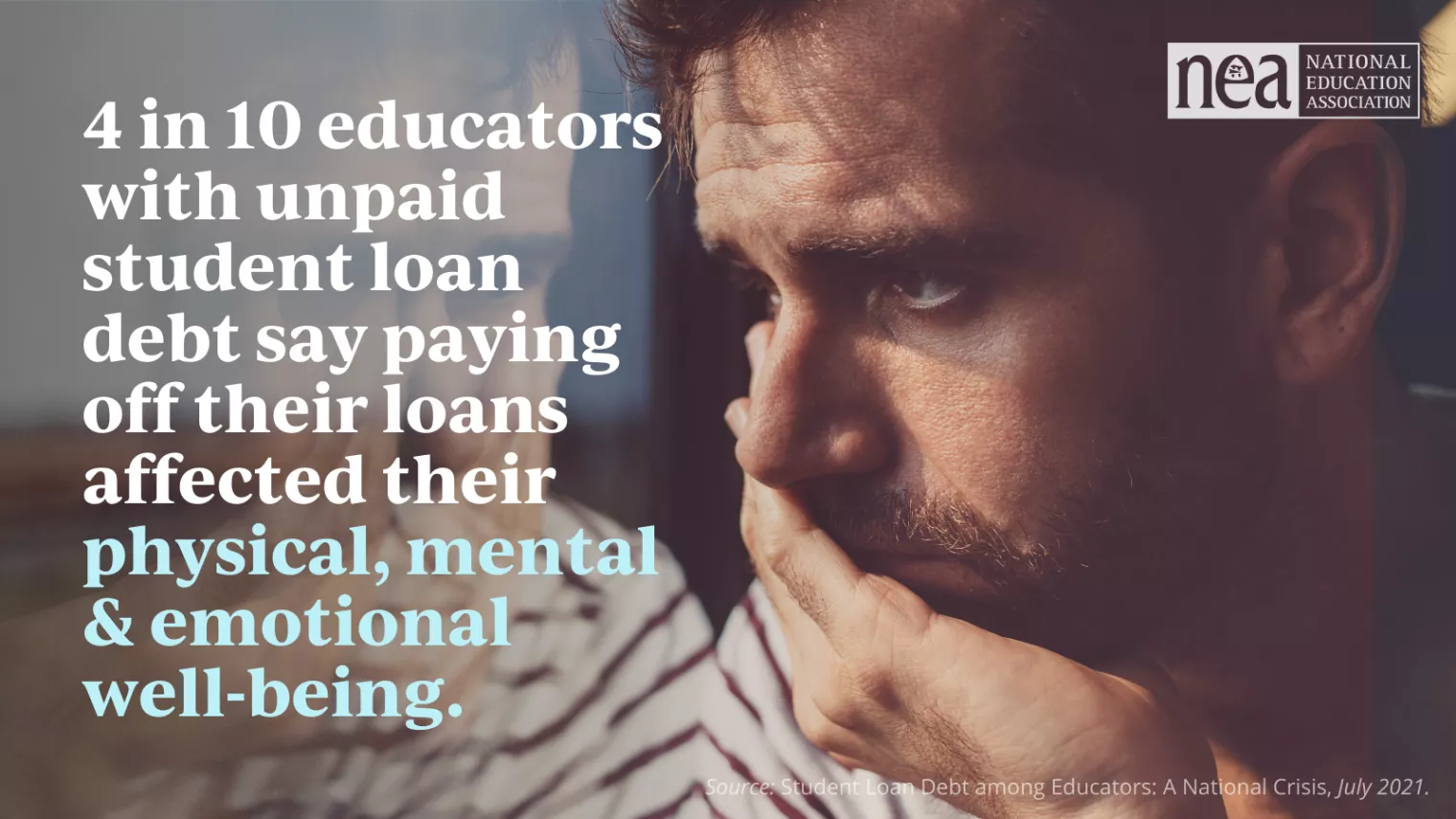

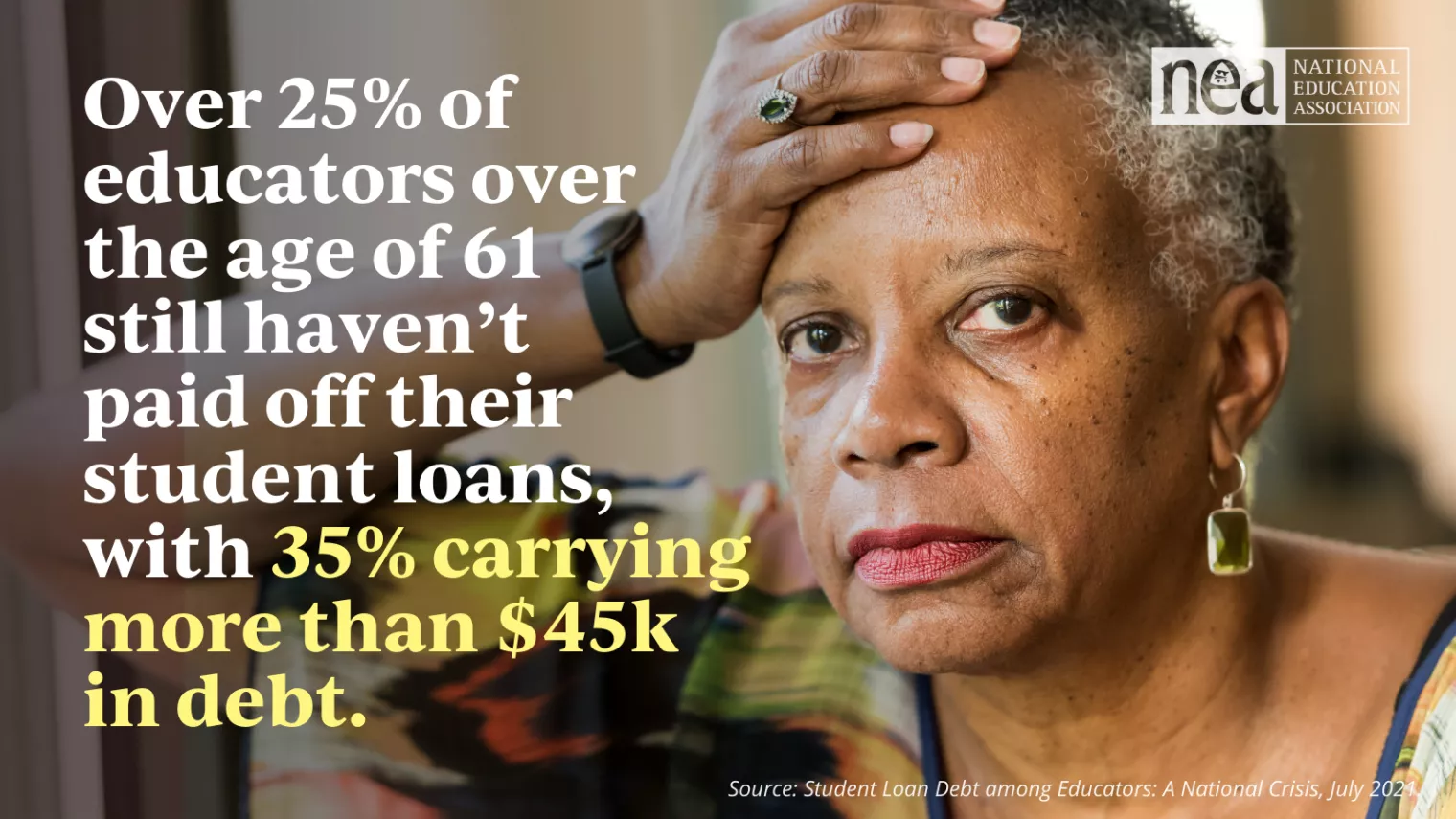

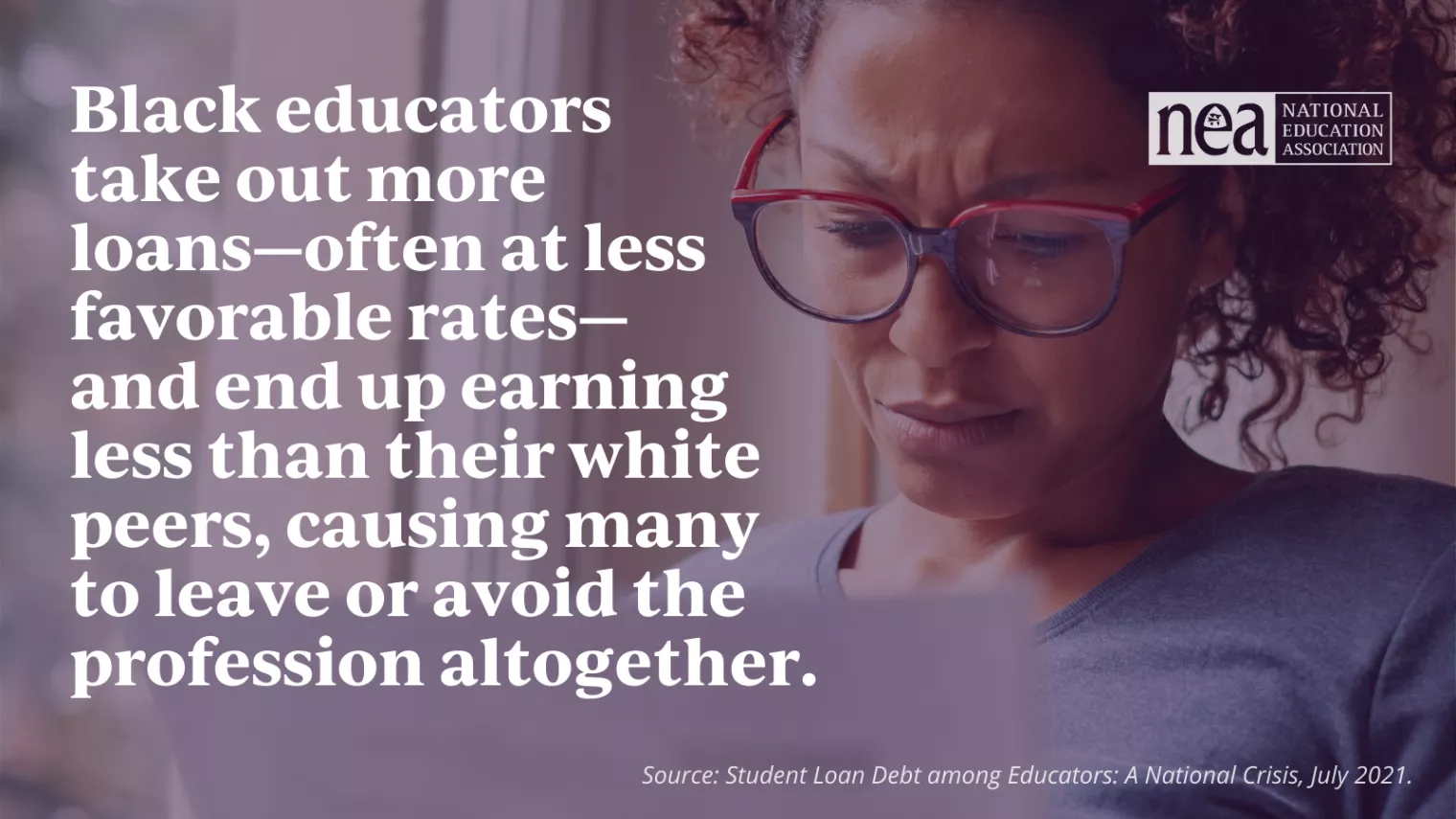

The July 2021 “Student Loan Debt Among Educators: A National Crisis” report presents the results of a 2020 NEA survey of educators working in pre-K–12 and higher education institutions regarding student loan debt. In line with research on student loan debt within the general population, we find that student loans play a significant role in the financial lives of many educators and have disproportionate impacts on specific subgroups. Click here to read the full report.

STUDENT LOAN DEBT AMONG EDUCATORS: BY THE NUMBERS

EXPERT BRIEFING

On July 29, 2021, NEA experts joined a special briefing to delve into the report, explore recent student debt news, and share resources to take action on a national, local, and personal level.

NEA members share their student debt stories

Our report found that no segment of educators is immune from the burden of student loan debt—not young educators, not older and more experienced educators, and certainly not educators of color.

With this crisis, however, comes the opportunity for transformation.

Resources

Check out more resources on NEA’s student debt page

Read more about NEA’s fight to fix Public Service Loan Forgiveness

Your union can help you get your education loans under control

Individual Student Debt Support

Student Loan Data Based On Educator Group

Pre-K–12 Teachers and Specialized Instructional Support Personnel

Pre-K–12 Educator Support Professionals

Higher Education Faculty

Higher Education Educator Support Professionals

!["My student debt from my doctorate [in education leadership] is still in the six figures. With NEA's help, I've started the process for federal loan forgiveness."](https://www.nea.org/sites/default/files/styles/1520wide/public/2021-07/Student%20Debt%20Quote%20-%20James%20-%20underlined%20-%20site%20%282%29.png.webp?itok=xzxNWRpk)

!["The total amount of debt for both [undergrad and graduate degrees from in-state, public colleges] is almost $200,000. I want to buy a house, but my student loans are the size of a mortgage."](https://www.nea.org/sites/default/files/styles/1520wide/public/2021-07/Student%20Debt%20Quote%20-%20Maggie%20-%20spaced%20-%20site%20%282%29.png.webp?itok=62hVjt_c)

!["Over the years, I've tried several times to get [debt] forgiveness. but I've been denied every time... I taught special education for 18 years and I still owe $20,000—and I'm a year into my retirement."](https://www.nea.org/sites/default/files/styles/1520wide/public/2021-07/Student%20Debt%20Quote%20-%20Pat%20-%20underlined%20-%20site.png.webp?itok=69_3snUa)