The Public Service Loan Forgiveness program was created in recognition of the many ways public service workers make our communities, and our nation, better.

The PSLF program has forgiven over $78 billion to over 1 million educators and other public service workers.

NEA’s student debt experts have created tools designed to help educators through the PSLF application process. Check them out below!

STORIES OF STUDENT DEBT FORGIVENESS

Apply for Public Service Loan Forgiveness

PSLF Eligibility

To qualify for PSLF, you must be employed full-time (30 hours or more per week) by a public service employer, which includes all public school districts and public and non-profit higher education institutions. This includes all educators:

- Teachers

- Education Support Professionals

- Specialized Instructional Support Personnel

- Higher Education Faculty, Including Adjunct/Contingent

How to Apply

- Connect with the U.S. Department of Education

- Go to studentaid.gov and login with your Federal Student Aid (FSA) ID (or create one if you do not have one.) Your FSA ID provides access to your student debt dashboard, which includes a wealth of historical information on your federal student loans and debt forgiveness opportunities. Make sure your FSA ID contact information is up to date. The Department of Education will use that information to contact you about the progress of your PSLF application.

- If you have a Direct Loan and have NOT applied for PSLF, visit studentaid.gov/PSLF

- Access the Department of Education’s PSLF Help Tool to fill out your PSLF application.

- Submit your Employment Certification Form (ECF)

- After completing the PSLF Help Tool, you will need to get your employer(s)’s signature on each completed form, and submit the application(s) to Federal Student Aid.

- If you have a FFEL, Perkins, or Parent Plus loan, you must first consolidate into a Direct Loan for your loans to be eligible for forgiveness under PSLF.

- See our consolidation FAQ on how consolidation calculates the number of eligible payments.

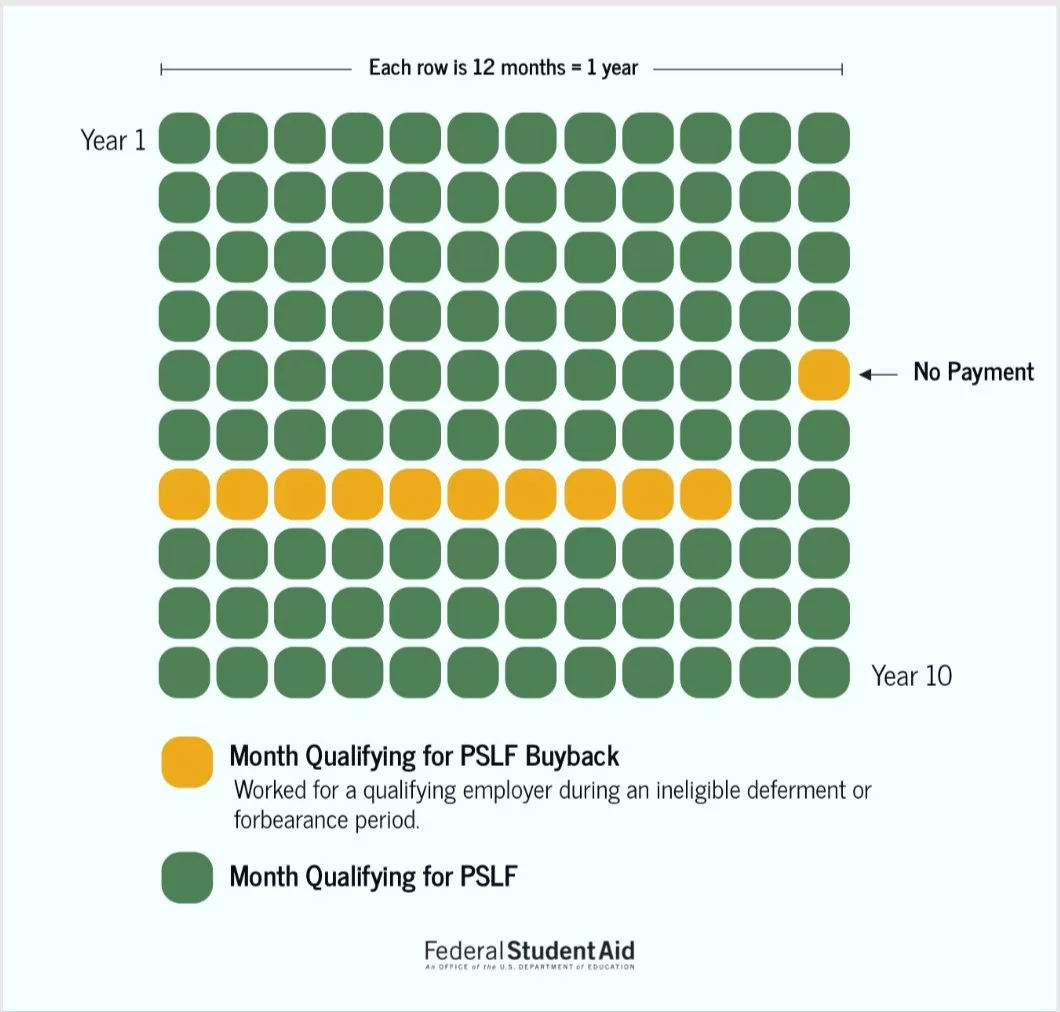

PSLF Buyback Program

Because of changes in PSLF regulation, borrowers can now “buy back” certain months in their payment history to make them qualifying payments for PSLF. This includes months borrowers were in deferment of forbearance status.

Borrowers can only buy back months if:

- They still have an outstanding balance on their loans;

- They have approved qualifying employment for those same months; and

- Buying back those months would complete the borrower’s total of 120 qualifying PSLF payments.

Example of How PSLF Buyback Works:

When buying back months, borrowers must make an extra payment of at least as much as what they would have made under an income-driven repayment (IDR) plan during the months the borrower is trying to buy back. The amount required will be based on the borrower’s income and family size at the time of the deferment or forbearance, not their current income and family size.

If you believe you qualify for buy back, you can submit a request through PSLF Reconsideration here. In your request, indicate “I am seeking PSLF and have at least 120 months approved of qualifying employment. Please assess my eligibility for PSLF buyback.”

Once you submit a request, you will get an automated email confirming receipt of your reconsideration request. While borrowers are unable to check the status of their reconsideration request, if you are eligible to buy back months, the U.S. Department of Education will respond within 90 days with a buy back agreement, which will include the amount to pay and instructions for paying the amount.

Meet the NEA Student Debt Navigator

Did you get your student debt cancelled through Public Service Loan Forgiveness? Help us continue to advocate for this program by sharing how PSLF helped you.

Frequently Asked Questions on Public Service Loan Forgiveness

Our experts answered some of the most common questions about Public Service Loan Forgiveness.